Identity theft has moved from being an occasional inconvenience to a persistent, everyday risk. Nearly every aspect of modern life, banking, shopping, healthcare, employment, and government services, relies on digital identity. That shift has made personal information more valuable than ever and far easier to misuse.

Data breaches, phishing scams, and account takeovers now happen at a scale where identity theft prevention alone is often not enough. Even people with strong passwords and good online habits can have their data exposed through breaches they cannot control. That’s why identity theft protection has become a practical necessity rather than a luxury.

Today, identity theft protection is about:

- Detecting misuse of your identity as early as possible

- Limiting financial and credit damage

- Reducing the time, stress, and complexity of recovery

In 2026, choosing not to have any form of identity theft protection often means accepting higher risk and longer recovery if something goes wrong.

→ Check Out this Comparison Spreadsheet

Who should use identity theft protection services

A common myth is that identity theft protection is only useful for wealthy individuals or heavy online shoppers. In reality, almost everyone can benefit from some level of protection.

Identity theft protection services are especially valuable for:

- People who use online banking, payment apps, or digital wallets

- Anyone with an active credit history

- Families with children (child identity theft often goes undetected for years)

- Seniors, who are frequently targeted by impersonation and scam attacks

- Freelancers, remote workers, and frequent travelers

If you’ve ever wondered how to protect yourself from identity theft, identity theft protection services exist to fill the gaps that personal habits and free tools leave behind.

How this guide evaluates the best identity theft protection providers

This guide is designed to be practical, unbiased, and easy to use. Instead of focusing on marketing claims, it evaluates the best identity theft protection options based on what actually matters to real users.

Key evaluation factors include:

- Monitoring depth (credit, dark web, personal data)

- Alert speed and clarity

- Identity theft recovery support

- Insurance coverage and limitations

- Price, transparency, and long-term value

Throughout the guide, you’ll also learn what is identity theft, how it happens, how to report identity theft, and how to recover if your identity is compromised so you can make informed decisions, not reactive ones.

→ Check Out this Comparison Spreadsheet

What Is Identity Theft?

What Is Identity Theft and How It Works

Clear explanation for beginners

Identity theft occurs when someone steals your personal information and uses it without your permission. This information may include your name, Social Security number, credit card details, bank account data, medical insurance information, or online login credentials.

In simple terms, identity theft means someone pretends to be you financially or legally to gain money, services, or benefits.

A typical identity theft cycle looks like this:

- Personal data is exposed (through a breach, scam, or theft)

- A criminal uses that data to open accounts or access existing ones

- Fraud continues until detected sometimes weeks or months later

Because so many systems rely on identity data rather than face-to-face verification, stolen information can be reused repeatedly if not caught early.

Why identity theft protection exists

Identity theft protection exists because individuals cannot realistically monitor every possible misuse of their identity on their own. Many forms of identity theft, such as tax fraud, medical identity theft, or synthetic identity theft, don’t trigger immediate financial alerts.

Identity theft protection services help by:

- Monitoring multiple data sources continuously

- Alerting you to suspicious activity early

- Guiding you through recovery if fraud occurs

This layered support is why identity theft protection has become a core part of modern digital safety.

Most Common Types of Identity Theft

Identity theft is not one single crime. It comes in several forms, each with different warning signs and consequences.

Financial identity theft

Financial identity theft is the most widely reported type. It involves using your identity to:

- Open credit cards or loans

- Make unauthorized purchases

- Access bank or investment accounts

This type directly impacts your finances and credit score and is often the first reason people seek identity theft protection.

Medical identity theft

Medical identity theft happens when someone uses your identity to receive healthcare services or prescription drugs.

Consequences may include:

- Incorrect medical records under your name

- Insurance claim denials

- Unexpected medical bills

This form of identity theft can be difficult to detect and potentially dangerous.

Tax identity theft

Tax identity theft occurs when criminals file a fraudulent tax return using your Social Security number to claim a refund.

Victims often discover this when:

- A legitimate tax return is rejected

- Tax authorities report income you didn’t earn

Tax identity theft usually requires extensive documentation to resolve.

Employment identity theft

In employment identity theft, someone uses your identity to obtain a job.

This can lead to:

- Unreported wages appearing under your name

- Tax complications

- Issues with government benefits

It often goes unnoticed until tax season.

Child and senior identity theft

Children and seniors are particularly vulnerable.

- Child identity theft often remains hidden for years because children don’t check credit reports

- Senior identity theft frequently involves impersonation scams, fake tech support, or financial manipulation

Protecting these groups is one of the strongest reasons families choose identity theft protection services.

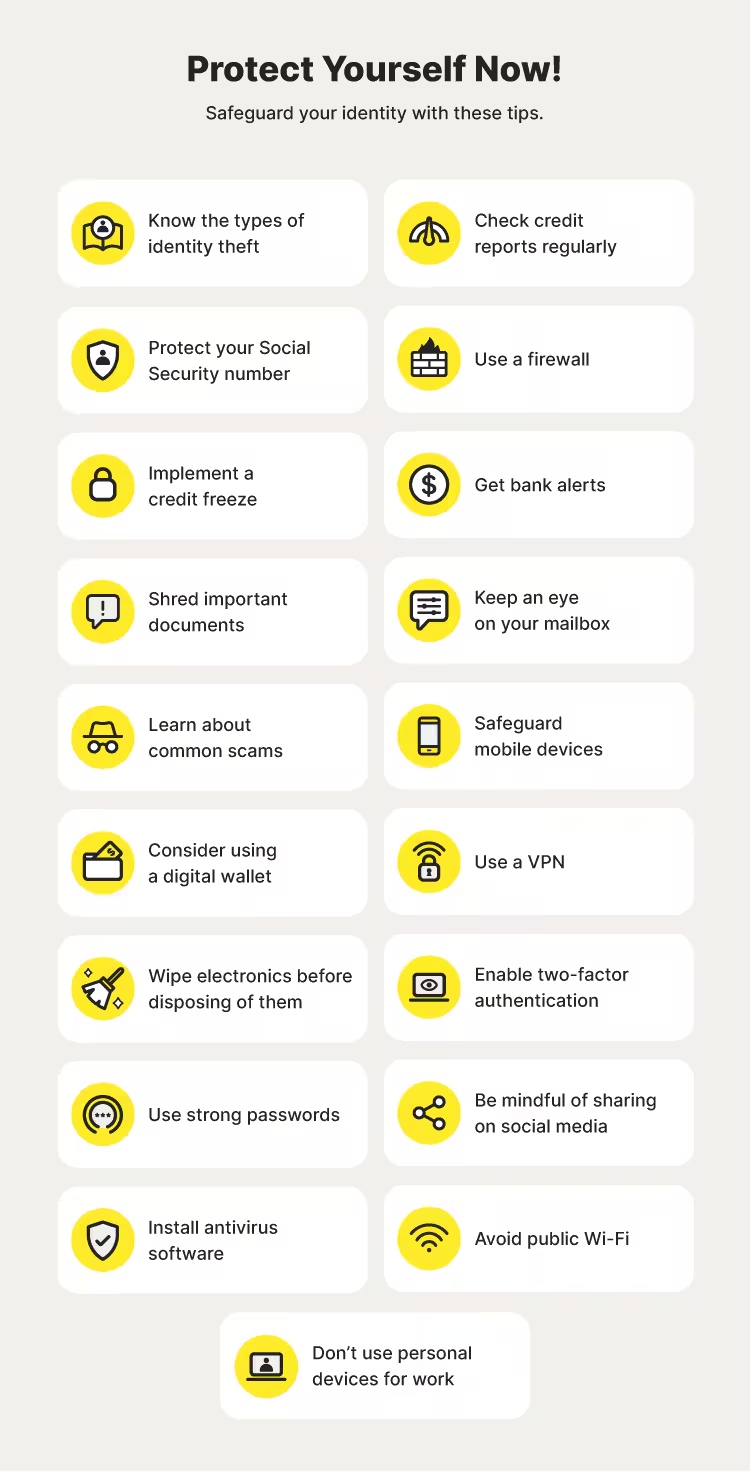

How to Protect Yourself From Identity Theft (Without Paid Services)

Not everyone needs a paid service immediately. If you’re disciplined and proactive, you can reduce your risk significantly using free tools and smart habits. This section focuses on identity theft prevention steps you can take on your own and where the limits start to appear.

Basic Identity Theft Prevention Steps

Password hygiene

Passwords are still one of the weakest links in personal security.

Best practices include:

- Use unique passwords for every account

- Prefer long passphrases over short passwords

- Never reuse passwords across email, banking, and shopping accounts

- Change passwords immediately after any data breach

Strong password hygiene is one of the most effective ways to protect yourself from identity theft without spending money.

Multi-factor authentication (MFA)

MFA adds a second verification step beyond your password, such as a code or app approval.

Why MFA matters:

- Stops most account takeover attempts

- Protects accounts even if passwords are leaked

- Is free on most major platforms

Enable MFA on email, financial accounts, cloud storage, and social media first.

Credit freezes

A credit freeze prevents new credit accounts from being opened in your name without explicit authorization.

Key points:

- Credit freezes are free in many regions

- Existing credit cards and loans continue to work

- You can temporarily lift the freeze when needed

Credit freezes are one of the strongest free defenses against financial identity theft.

Advanced Identity Theft Prevention

Once the basics are covered, advanced steps help reduce exposure even further.

Dark web checks

Some data breach notification tools allow you to check whether your email or credentials appear in known leaks.

While manual checks are useful:

- They are not continuous

- They don’t monitor SSNs or full identity profiles

- They often alert after data is already circulating

This is where free tools begin to show their limitations compared to identity theft protection services.

Secure browsing

Daily browsing habits have a major impact on identity theft risk.

Safer browsing includes:

- Avoiding suspicious downloads and pop-ups

- Only entering personal data on HTTPS websites

- Limiting browser extensions to trusted sources

- Logging out of accounts on shared devices

Secure browsing reduces phishing and malware-based identity theft.

Device hardening

Your devices are gateways to your identity.

Strengthen them by:

- Keeping operating systems and apps updated

- Using reputable antivirus or endpoint protection

- Locking devices with biometrics or strong PINs

- Enabling remote wipe features

Device hardening supports long-term identity theft prevention, especially for mobile users.

🔥 Best Identity Theft Protection Services (Side-by-Side Overview)

Free tools can lower risk, but they don’t replace full identity theft protection. This core commercial section explains how the best identity theft protection services are evaluated and compared, helping readers quickly identify the right option.

How We Ranked the Best Identity Theft Protection Services

To determine the best identity theft protection, we focused on real-world effectiveness rather than marketing claims. The ranking criteria below directly impact prevention, detection, and recovery outcomes.

Monitoring depth

The best services go beyond basic credit alerts by offering:

- Three-bureau credit monitoring

- Dark web surveillance for leaked credentials

- Monitoring of SSNs, phone numbers, and emails

- Alerts for high-risk identity activity

Deeper monitoring means earlier detection and less damage.

Recovery assistance

Recovery support is one of the biggest differences between average and top-tier identity theft protection services.

High-quality recovery includes:

- Dedicated identity restoration specialists

- Step-by-step recovery plans

- Help with disputes, affidavits, and paperwork

- Ongoing follow-up until resolution

This is critical when learning how to report identity theft and clean up after it.

Insurance coverage

Identity theft insurance helps cover recovery-related costs.

Important factors:

- Coverage limits (often up to six or seven figures on premium plans)

- What expenses are covered (legal fees, lost wages, mailing costs)

- Clear exclusions and conditions

Insurance doesn’t prevent fraud, but it reduces financial stress during recovery.

Pricing and value

The best identity theft protection isn’t always the cheapest, it’s the most cost-effective for your risk level.

We considered:

- Monthly vs annual pricing

- Feature availability at each tier

- Price stability after promotional periods

- Whether bundled tools add real value

Quick Comparison Table (Summary)

Below is a high-level comparison designed for fast decision-making. Details vary by plan, but this table highlights how services typically differ.

Identity Theft Protection Service Lineup (2026)

This Identity Theft Protection Service Lineup highlights two of the most widely recognized services in 2026: Aura and LifeLock. Both are designed to help prevent, detect, and assist with recovery from identity theft, but they take slightly different approaches and appeal to different kinds of users.

Aura Identity Theft Protection Review

Overview of Aura Identity Theft Protection

Aura positions itself as a comprehensive all-in-one identity and digital security suite. Unlike solutions that focus solely on identity alerts, Aura combines identity theft protection with cybersecurity tools like VPN, antivirus, and a password manager, all under one roof. Each plan typically includes three-bureau credit monitoring, dark web scanning, and up to $1 million in identity theft insurance per adult (up to $5 million on family plans).

Key Features

Aura’s core identity theft protection features include:

- 3-bureau credit monitoring for early alerts

- Identity and personal data monitoring (SSN, emails, etc.)

- Dark web scanning for exposed credentials

- Financial transaction alerts

- Home and auto title monitoring

- Identity theft insurance covering legal fees, lost wages, and other expenses

- Antivirus and VPN included for device security

- Password manager and privacy assistant

- 24/7 U.S.-based support

Aura also offers parental controls and features tied to child monitoring, making it a broader digital safety tool as much as an identity theft protection service.

Pros and Cons

Pros

- Comprehensive protection: Combines identity theft, credit, and digital security in one plan.

- All plans include key features: Unlike some competitors, most identity and monitoring features aren’t locked behind expensive tiers.

- Family-friendly: Family plans can cover multiple adults and unlimited children.

- Strong alerts: Fast notifications across credit and identity signals.

Cons

- Can be feature-dense: The breadth of tools and apps may feel complex for some users.

- Higher-end extras may be under-utilized if you only want identity monitoring.

- Lacks some advanced credit analytics like simulators or frequent score updates.

Pricing and Plans

Aura’s pricing varies by plan type: individuals, couples, and families. Plans typically start around $12–$15 per month for individuals, with family plans higher. Annual billing may reduce the effective monthly cost.

| Plan Type | Typical Monthly Price (Approx.) | Key Coverage |

| Individual | $12–$15 | Identity & credit monitoring, insurance |

| Couple | ~$22–$29 | All features x2 adults |

| Family | ~$32–$50 | Multiple adults + unlimited kids |

Note: Promotional pricing and trials (e.g., 14-day free trial) are often available, and many plans include a 60-day money-back guarantee.

Who Should Use Aura?

Aura is a great choice if you want:

- All-in-one protection: Identity theft, credit alerts, and cybersecurity bundled together.

- Family coverage: Especially if you want kids or multiple adults covered together.

- Long-term peace of mind: Continuous monitoring with robust alerting and remediation support.

Who Should Avoid Aura?

Aura might be less ideal if:

- You want very basic credit monitoring only without additional tools.

- You prefer simpler, standalone identity monitoring without a larger digital security suite.

- You’re extremely price-sensitive and prefer minimal, free monitoring alternatives.

LifeLock Identity Theft Protection Review

Overview of LifeLock Identity Theft Protection

LifeLock is one of the most established and widely recognized identity theft protection brands, now integrated with Norton’s broader cybersecurity suite. LifeLock focuses heavily on identity and financial protection, with options to bundle antivirus, VPN, and password manager tools via

Norton 360 packages. Its higher-tier plans include extensive credit monitoring and some of the industry’s largest identity theft insurance limits, making it a good choice for users who want deep coverage and aren’t budget-limited.

Monitoring and Alert Capabilities

LifeLock provides:

- Credit monitoring: Varies by plan; higher tiers include full three-bureau checks

- Dark web scanning and breach alerts

- SSN and identity data monitoring

- Bank accounts and investment account monitoring at higher tiers

- Alerts for unusual financial or identity activity

Bundling with Norton 360 gives access to VPN, antivirus, and password manager tools, though these bundled features may cost more and are optional.

Pros and Cons

Pros

- Strong brand reputation and long track record.

- Deep insurance limits: Premium plans may offer up to $3 million coverage for various identity theft costs.

- Comprehensive monitoring: Especially on higher tiers, including financial and account takeover signals.

- Integration with Norton suite for optional cybersecurity add-ons.

Cons

- Pricing complexity: Multiple tiers with features spread across them, which can be confusing.

- Higher cost for full features — many protections require premium plans.

- Some alerts and monitoring only appear on top-level subscriptions, which may not fit all budgets.

Pricing Breakdown

LifeLock pricing depends on the level of protection you choose. Entry-level plans may start lower but lack full credit monitoring, while premium plans with extensive monitoring and high insurance limits are more expensive overall. Renewal pricing may be higher than first-year incentives.

- Entry / Basic tiers: Lower cost but limited monitoring

- Mid-range plans: Include more credit and identity monitoring

- Ultimate Plus / Premium tiers: Most comprehensive identity theft protection, insurance, and optional Norton 360 cybersecurity features

LifeLock vs Competitors

Compared to Aura, LifeLock tends to:

- Offer higher insurance limits on premium plans.

- Spread features across multiple pricing tiers, which may require buying up for full coverage.

- Provide optional cybersecurity bundles (via Norton), appealing to users who want both identity and device protection in one place.

Aura, by contrast, includes many features across all plans and is often seen as more straightforward and value-focused.

Summary

- Aura is often recommended for most users seeking comprehensive identity and credit protection with strong monitoring and a simpler pricing structure.

- LifeLock is ideal for those who want deep monitoring and high insurance limits and are comfortable with a multi-tier pricing approach that may cost more overall.

Both services are among the top best identity theft protection options in 2026, and which one is right depends on your needs, budget, and how much monitoring depth and recovery support you want.

IdentityGuard Identity Theft Protection Review

IdentityGuard Features Explained

IdentityGuard is a long-standing and highly customizable identity theft protection service that emphasizes advanced monitoring technology, including AI-powered risk scoring and alerts. Its approach blends traditional credit surveillance with proactive identity risk detection, making it a compelling choice for users who want a flexible, data-driven service.

Key features often include:

- Extensive credit monitoring with options for 1-bureau or 3-bureau coverage

- Dark web scanning for exposed personal data (email addresses, SSNs, passwords)

- Public records monitoring (change of address, court filings, liens, etc.)

- Account takeover alerts and risk scoring

- Identity restoration support if fraud is detected

- Identity theft insurance covering eligible recovery expenses

IdentityGuard packages frequently allow users to tailor their coverage depending on risk tolerance and budget.

AI-Based Identity Theft Detection

One of IdentityGuard’s standout differentiators is its use of artificial intelligence to enhance detection:

- Behavioral analytics to identify unusual patterns that traditional rules-based systems may miss

- Risk scoring models that help prioritize alerts based on likelihood of fraud

- Machine learning updates that evolve as new fraud tactics are identified

This AI-driven approach aims to reduce false positives and focus your attention on signals that matter. For users concerned about emerging threats like synthetic identity theft or coordinated credential misuse, this capability can add important value.

Pros and Cons

Pros

- Strong technology foundation: AI-based monitoring enhances detection accuracy

- Customizable plans: Choose credit and identity monitoring based on your needs

- Comprehensive personal data scanning: Goes beyond basic credit alerts

- Detailed risk insights and alert prioritization

Cons

- Feature visibility can be complex: Some users find the array of options and tiers confusing

- Mid-range plans may still lack full credit bureau coverage depending on the package

- Recovery support quality varies by tier: Best assistance often reserved for higher plans

Cost and Plan Comparison

IdentityGuard typically offers multiple tiers that vary in monitoring depth and features:

| Plan | Credit Bureau Monitoring | Dark Web Scanning | AI Risk Scoring | Insurance Coverage |

| Basic | 1 bureau | Yes | Standard | Basic |

| Mid | 3 bureau | Yes | Advanced | Standard |

| Premium | 3 bureau | Yes | Premium | Higher limits |

Pricing tends to reflect the level of monitoring and support, with premium tiers positioned toward users who want comprehensive protection and advanced analytics. Cost effectiveness increases when purchased annually.

Best Use Cases

IdentityGuard is particularly strong for users who:

- Want AI-enhanced identity theft detection

- Prefer customizable protection packages

- Are comfortable choosing and managing tiered features

- Appreciate deeper insights beyond basic credit monitoring

It’s a good fit if you value proactive alerts and prioritization to help distinguish between low-risk events and potentially serious identity threats.

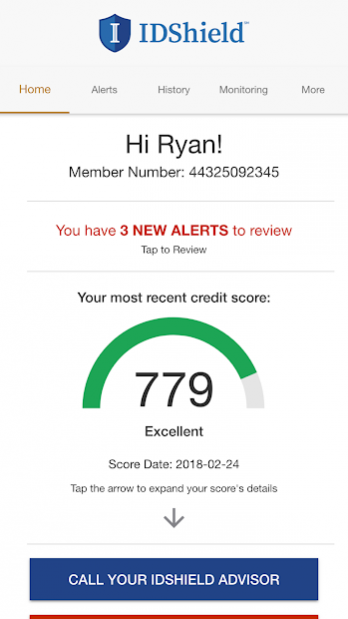

IDShield Identity Theft Protection Review

What Makes IDShield Different

IDShield is a specialized identity theft protection service with a strong emphasis on dedicated support and restoration. While many providers offer monitoring and alerts, IDShield pairs that with access to professional investigators who guide you through recovery if fraud occurs.

Core features include:

- Comprehensive credit monitoring

- Dark web and public records scanning

- Bank account and financial account monitoring

- Identity restoration services supported by licensed professionals

- Identity theft insurance covering eligible recovery costs

The standout feature here is the integration of licensed investigators directly into the recovery process, an element that sets IDShield apart from many competitors.

Licensed Private Investigators

Unlike standard identity theft protection services that provide general support teams, IDShield connects you with licensed private investigators (LPIs) when identity theft is detected. These professionals help:

- Analyze fraud patterns specific to your case

- Prepare and file dispute letters

- Communicate with creditors, bureaus, and collections

- Guide documentation and case strategy

This level of expert involvement can accelerate resolution and reduce stress, especially when dealing with complex or multi-jurisdictional fraud.

Pros and Cons

Pros

- Professional, investigator-led restoration support

- Strong monitoring across credit and identity indicators

- Helpful for users who want hands-on assistance

- Clear escalation path when fraud is confirmed

Cons

- Can be more expensive than basic monitoring-only services

- Some features (e.g., advanced monitoring) are tiered at higher price points

Pricing and Value

IDShield generally structures plans based on coverage levels (individual vs family) and degree of monitoring. The inclusion of licensed private investigators often positions its plans at a premium compared with basic identity theft protection services—but many users find the additional support worth the cost.

Value considerations:

- Higher cost often correlates with deeper support and recovery expertise

- Family plans may provide added cost efficiency relative to multiple individual plans

- Annual billing typically offers the best price per month

Ideal Users

IDShield is best for people who:

- Want hands-on, professional help when identity theft occurs

- Value expert guidance and documentation support

- Have complex credit profiles, business ties, or long credit histories

- Prefer high-touch service over self-guided recovery

It’s especially useful for those who see identity theft not just as a risk, but as an event worth professional oversight.

Experian Identity Theft Protection Review

Experian’s Credit-Focused Protection

Experian Identity Theft Protection leans into Experian’s core strength: credit data. Built on one of the three major credit bureau platforms, it provides credit alerts, score tracking, and identity monitoring tools tied directly to your credit file.

Key offerings often include:

- Experian credit report and score access

- Credit bureau monitoring (often 3-bureau depending on plan)

- Alerts for new accounts and credit inquiries

- Dark web and identity monitoring

- Identity theft insurance for qualified losses

Because it’s rooted in a credit bureau, Experian’s service is particularly well-suited to users focused on credit-related identity threats.

Credit Monitoring Strengths

When credit risk and unauthorized account openings are your main concern, Experian excels:

- Fast credit alerts for new accounts

- Direct access to Experian credit reports and scores

- Tools for understanding changes in credit status

- Integration with credit score tracking and educational tools

This focus helps users catch and address fraud that shows up as changes on their credit reports before it escalates.

Pros and Cons

Pros

- Strong credit monitoring backbone

- Easy access to credit reports and score history

- Seamless alerts tied to credit changes

- Good choice for credit-centric identity risk management

Cons

- Less emphasis on non-credit data (e.g., SSN misuse outside credit context)

- May feel narrower in scope than some broader identity theft protection services

- Free tiers may be limited compared to paid plans

Free vs Paid Plans

Experian often offers a free tier that includes basic credit monitoring and score access. This is useful for users who want to watch credit activity without paying.

Paid plans usually add:

- 3-bureau monitoring

- Dark web surveillance

- Identity theft insurance

- Advanced alerts

Comparing free vs paid helps determine whether you need deeper coverage or are comfortable with basic monitoring alone.

Best for Credit Monitoring Users

Experian Identity Theft Protection is a strong choice if your primary goal is credit-related identity theft detection. It’s especially valuable for:

- People who want direct access to credit scores and reports

- Users focused on unauthorized credit applications

- Those who want simple, credit-centric alerts tied to their credit file

However, if you want wide-ranging identity theft protection (medical, tax, employment, or SSN misuse beyond credit), you may need a broader-scope plan from other providers.

IdentityForce Identity Theft Protection Review

IdentityForce is a long-standing identity theft protection provider now recommended by major review sites as a solid mid-tier option. It’s known for comprehensive monitoring and robust credit surveillance, though some competitors may offer broader “digital security bundles.”

Military-Grade Protection Explained

IdentityForce doesn’t literally provide military-issued tools, but its protection philosophy emphasizes high-assurance monitoring and robust alerting backed by nearly two decades of experience. Its systems watch for identity misuse, data leakage, and credit-related fraud across multiple vectors to detect threats early and help you respond before serious damage occurs.

Many reviewers highlight IdentityForce’s strong foundation in credit bureau data, dark web scanning, and breach alerts, giving members a broad view of their identity risk landscape.

Monitoring Scope

IdentityForce’s monitoring typically includes:

- Three-bureau credit monitoring on premium plans (Equifax, Experian, TransUnion)

- Credit scores and reports included with higher tiers

- Dark web scanning for exposed personal data such as SSNs, emails, and credentials

- Alerts for changes in credit file, public records, and unusual activity

- Transaction and account alerts that flag suspicious activity

All IdentityForce plans generally include dark web monitoring and at least $1 million in identity theft insurance, providing a baseline safety net across pricing tiers.

Compared to some competitors, IdentityForce’s emphasis on credit data and broad alert channels makes it a good choice if you’re particularly concerned about fraud that shows up through credit patterns.

Pros and Cons

Pros

- Comprehensive credit and identity monitoring backed by TransUnion data sources (premium tiers).

- Dark web surveillance included and alerts for breached credentials or exposed personal information.

- Identity theft insurance included with most plans.

- Customizable plans let you tailor monitoring depth to needs and budget.

Cons

- Entry-level plans often lack full credit bureau monitoring unless you pay for a premium tier.

- Does not include some broader digital security tools like antivirus or VPN (usually bundled elsewhere).

- Pricing can feel high relative to comparable services if you want maximum credit and identity coverage.

Pricing Details

IdentityForce pricing depends on the tier you choose:

- Base plans: Start around $19.90 per month and include core monitoring and alerts.

- UltraSecure + Credit: Typically around $34.90 per month and adds full three-bureau credit monitoring, reports, and scores.

- Family Plans: Protect two adults and up to 10 children under a single subscription, often at a modest surcharge.

Annual billing usually provides better value by lowering the effective monthly cost.

Best For Families and High-Risk Users

IdentityForce suits users who want solid credit-centric identity theft protection without bundling other digital security tools. Its monitoring depth and proactive alerts help catch threats early, particularly when you’re focused on your credit profile and related fraud signals.

Families and users who prioritize three-bureau credit alerts, breach notifications, and straightforward identity coverage will find IdentityForce’s structure appealing, especially if you value monitoring scope and credit detail over extras like antivirus or VPN.

Free Identity Theft Protection Options (Are They Enough?)

While paid identity theft protection services provide broader monitoring and guided recovery, free options offer a valuable baseline especially for users with tighter budgets or lower risk profiles.

Credit Bureau Free Tools

All three major credit bureaus now allow consumers to check their credit reports weekly at no cost, which helps track account openings and other changes that may indicate fraud. You can sign up for these free weekly reports directly from official channels.

Experian also offers free credit monitoring services that alert you to changes in your credit file. These alerts can help detect early signs of identity theft.

Additionally, certain third-party memberships include free identity protection perks for example, AAA’s ProtectMyID offers free credit monitoring and basic identity alerts to members, along with limited identity theft insurance.

Bank-Provided Protection

Many banks and credit unions include free identity theft protection tools or alerts as part of their services. These may include:

- Credit and debit transaction alerts

- Dark web scans for breached credentials

- Lost wallet support

- Basic restoration help

Some financial institutions even offer limited identity restoration assistance or insurance tied to account membership.

For example, certain banking identity monitoring tools notify you if your SSN is found on the dark web or if there’s unusual account activity and may include help if your identity is compromised.

Limitations of Free Identity Theft Protection

Free tools are useful, but they typically have important limitations:

- Narrow monitoring scope: Free credit monitoring may only cover one bureau or provide limited alert types.

- No recovery support: Unlike paid services, free tools usually don’t include guided identity restoration specialists.

- Limited insurance: Any identity theft insurance included is often modest compared with the coverage paid plans offer.

- Delayed alerts: Free tools may update less frequently or send alerts more slowly than dedicated services.

In other words, free protections help you detect possible fraud earlier than nothing at all, but they usually aren’t enough on their own to fully replace the depth of coverage and recovery support that comes with the best identity theft protection services.

Identity Theft Protection for Families, Seniors & Children

Identity theft doesn’t affect everyone the same way. Families, children, and seniors face unique risks, which is why choosing the right identity theft protection often depends on who you’re protecting, not just yourself.

Child Identity Theft Protection

Child identity theft is one of the most overlooked forms of identity crime. Because children usually don’t have active credit files, stolen information can be misused for years without detection.

Common child identity theft risks include:

- Opening credit accounts using a child’s SSN

- Applying for government benefits

- Creating synthetic identities using partial child data

Effective child identity theft protection focuses on early detection, not credit scores.

What to look for:

- Monitoring of a child’s SSN and personal data

- Alerts for suspicious activity tied to a minor’s identity

- Recovery assistance specifically for child identity cases

- Family dashboards that let parents manage protection centrally

For families, identity theft protection that includes child monitoring can prevent serious financial and legal problems later in life.

Senior Identity Theft Protection

Seniors are frequently targeted because scammers assume:

- Higher savings or fixed incomes

- Less familiarity with evolving digital scams

- Greater trust in authority figures

Senior-focused identity theft protection is less about complex tech and more about clarity, alerts, and recovery help.

Common senior identity theft threats:

- Phone and impersonation scams

- Fake tech support or account warnings

- Financial manipulation or unauthorized transfers

Ideal features for seniors include:

- Simple, easy-to-understand alerts

- Financial account monitoring

- Strong recovery support with real human assistance

- Family or trusted contact access

For older adults, identity theft protection acts as both a warning system and a safety net during recovery.

Family Plan Comparisons

Family identity theft protection plans bundle coverage for multiple people under one subscription. These plans often provide better value than buying individual coverage.

Typical family plan features:

- Coverage for two adults

- Coverage for multiple children (sometimes unlimited)

- Shared monitoring dashboards

- Consolidated recovery support

Family plans are best when:

- You want consistent protection across the household

- Children or seniors are part of the risk profile

- You prefer centralized alerts and billing

When comparing family plans, focus on child coverage limits, insurance caps per person, and whether recovery specialists assist the whole household.

How to Choose the Best Identity Theft Protection for You

With so many options available, choosing the best identity theft protection can feel overwhelming. A structured approach makes the decision clearer and more confident.

Feature Checklist

Before choosing a service, verify it covers the essentials.

Core features to prioritize:

- Credit monitoring (preferably three-bureau)

- Dark web and personal data monitoring

- Fast, clear alerts

- Identity theft recovery assistance

- Identity theft insurance for recovery costs

Additional features that may matter depending on your situation:

- Child identity monitoring

- Family dashboards

- Financial account monitoring

- Dedicated recovery specialists

If a service lacks strong recovery support, it’s closer to credit monitoring than full identity theft protection.

Budget vs Coverage Tradeoffs

Not everyone needs the most expensive plan, but underbuying protection can cost more later.

How to think about tradeoffs:

- Lower-cost plans usually offer limited monitoring and little recovery help

- Mid-range plans balance monitoring depth and affordability

- Higher-tier plans provide maximum coverage, insurance, and guided recovery

Ask yourself:

- How much time could you realistically spend recovering on your own?

- Would guided help reduce stress and disruption?

- Are you protecting just yourself or others too?

The best identity theft protection is the one that matches both your risk level and time availability.

Red Flags When Choosing a Service

Avoid identity theft protection services that show these warning signs:

- Claims to “guarantee” the prevention of all identity theft

- Vague explanations of what is monitored

- Hidden fees or unclear renewal pricing

- Insurance coverage without clear terms

- Limited or outsourced recovery support

Transparency is a strong indicator of quality. If a provider can’t clearly explain how it helps you prevent, detect, and recover, it’s not the best choice.

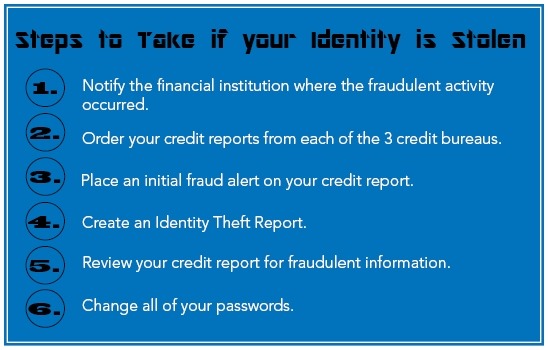

How to Report Identity Theft

Knowing how to report identity theft correctly is critical. Fast, well-documented action can limit financial losses, prevent further misuse of your identity, and significantly shorten recovery time even before identity theft protection services step in.

Immediate Steps After Identity Theft

The moment you suspect identity theft, focus on containment and documentation.

Take these steps right away:

- Secure compromised accounts (banking, credit cards, email first)

- Change passwords and enable multi-factor authentication

- Contact banks and card issuers to report unauthorized activity

- Pause or freeze accounts if advised by the institution

- Start a recovery log (dates, names, case numbers, actions taken)

These first actions are essential to stop ongoing fraud and are a core part of how to protect yourself from identity theft once exposure occurs.

How to Report Identity Theft to the FTC

In the U.S., the Federal Trade Commission (FTC) is the primary authority for identity theft reporting.

When you file a report with the FTC:

- You receive an official Identity Theft Report

- You get a personalized recovery plan

- The report acts as legal documentation when disputing fraud

Why this matters:

- Credit bureaus and lenders rely on FTC reports

- It strengthens disputes and accelerates corrections

- It establishes a formal timeline of the theft

Filing an FTC report is a required step in nearly every serious identity theft recovery process.

Reporting to Credit Bureaus and Banks

Once the FTC report is filed, notify the institutions affected.

Credit bureaus

- Place a fraud alert or credit freeze

- Dispute fraudulent accounts and inquiries

- Request confirmation when corrections are made

Banks and lenders

- Submit fraud claims

- Close compromised accounts

- Request provisional credits where applicable

This coordinated reporting prevents new fraud and creates the foundation for recovery especially when identity theft protection services are involved.

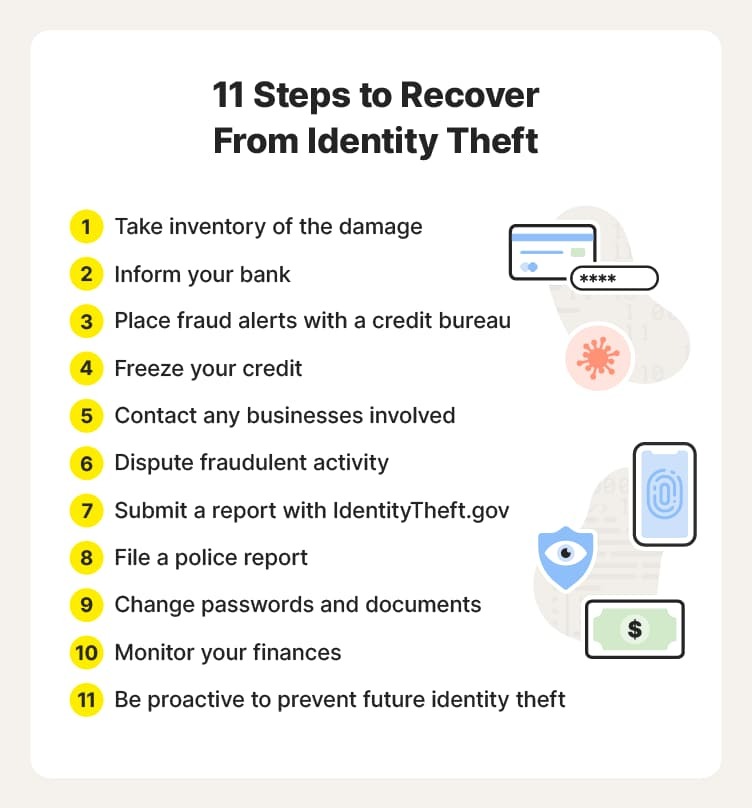

Identity Theft Recovery: Step-by-Step Guide

Identity theft recovery is a process, not a single action. Understanding what happens next helps set realistic expectations and reduces frustration.

What Happens After You Report Identity Theft

After reporting, recovery typically includes:

- Verification reviews by banks and bureaus

- Temporary credits or account reversals

- Formal dispute investigations

- Requests for additional documentation

During this phase, patience and organization matter. Many delays happen due to missing paperwork or incomplete responses not because claims are denied.

Recovery Timelines

Recovery timelines vary depending on the type and severity of identity theft.

Typical ranges:

- Account takeover or card fraud: days to a few weeks

- Credit account fraud: 30–90 days

- Tax, employment, or medical identity theft: several months or longer

Ongoing monitoring is essential because some fraud resurfaces after initial resolution especially with reused identity data.

How Identity Theft Protection Helps During Recovery

This is where identity theft protection delivers its biggest value.

During recovery, good services provide:

- Dedicated recovery specialists

- Step-by-step guidance and prioritization

- Help with dispute letters and affidavits

- Follow-ups until issues are fully resolved

- Coverage for eligible recovery expenses through insurance

Instead of navigating recovery alone, identity theft protection reduces time, stress, and costly mistakes especially in complex cases.

Identity Theft Protection Myths

Misconceptions cause people to delay protection or underestimate risk. Let’s address the most common myths directly.

I Don’t Need Identity Theft Protection

Reality: Identity theft isn’t about wealth, it’s about usable data.

Criminals target:

- Social Security numbers

- Email accounts

- Credit profiles

- Basic personal identifiers

Even people with modest finances can face serious damage, long recovery times, and legal complications. Identity theft protection is about impact reduction, not luxury.

My Bank Covers Everything

Banks help but they don’t handle the full picture.

Banks usually:

- Reverse unauthorized transactions

- Secure affected accounts

They don’t:

- Fix credit reports across bureaus

- Resolve tax or employment identity theft

- Manage disputes with multiple institutions

- Track long-term identity misuse

That gap is exactly why identity theft protection services exist.

Free Tools Are Enough

Free tools are helpful but limited.

They usually:

- Monitor only part of your identity

- Provide delayed alerts

- Offer little or no recovery support

- Include minimal or no insurance

Free tools support identity theft prevention, but they rarely replace full identity theft protection especially once fraud occurs.

FAQs About Identity Theft Protection

Is identity theft protection worth it?

Yes, identity theft protection is worth it for most people, especially in an era of widespread digital data use and frequent breaches. While free tools and good habits are important, they can leave gaps in monitoring and recovery. Paid identity theft protection services provide:

- Continuous monitoring of credit, personal data, and the dark web

- Timely alerts when suspicious activity occurs

- Guided recovery support if identity theft happens

- Insurance coverage for eligible costs during restoration

These services don’t prevent every possible threat, but they help you detect identity misuse earlier and navigate recovery more smoothly. For many, the time, stress, and potential financial losses avoided make identity theft protection highly valuable.

What is the best identity theft protection service?

There’s no single “best” option for everyone, but in 2026, the best identity theft protection services typically excel in the following areas:

- Best overall: A service that offers broad monitoring (credit, SSN, dark web), strong alerts, helpful recovery support, and solid insurance

- Best budget choice: Services that cover essential credit and identity signals without expensive extras

- Best for families: Identity theft protection with child monitoring and family dashboards

- Best for recovery support: Plans with dedicated specialists and robust insurance

Providers like Aura, LifeLock, IdentityGuard, IDShield, IdentityForce, and Experian often appear in expert comparisons because each brings strengths in different categories. The best choice depends on your risk level, budget, and how much support you want during recovery.

Can identity theft protection prevent identity theft?

Identity theft protection cannot prevent all identity theft, but it significantly improves detection and response. These services help you spot suspicious behavior quickly and initiate recovery steps faster than you likely would on your own.

Identity theft protection works alongside good personal security habits, such as strong passwords and multi-factor authentication to reduce exposure and containment time when threats occur.

How long should you keep identity theft protection?

There’s no one-size-fits-all answer, but most experts recommend maintaining some level of identity theft protection long-term, especially if:

- You regularly use online financial accounts

- You want ongoing monitoring of credit and personal data

- You’ve had your information exposed in a breach

- You’re protecting children or seniors

Because identity theft can emerge long after a breach or exposure, ongoing monitoring and early warning systems are often more effective than temporary coverage.

Final Verdict: Best Identity Theft Protection in 2026

Choosing the best identity theft protection depends on your priorities whether that’s comprehensive monitoring, cost efficiency, family coverage, or expert recovery support. Here’s a clear breakdown of 2026’s top picks by category:

Best overall identity theft protection

Aura

Why it stands out:

- Broad monitoring (credit, dark web, personal data)

- Strong alert system

- Family plans that include children

- Bundled cybersecurity tools (password manager, VPN)

- Excellent recovery support and insurance coverage

Aura offers an effective balance of features, usability, and protection value for most individuals and families.

Best budget option

Experian Identity Theft Protection (Paid Tier)

Why it stands out:

- Affordable access to three-bureau credit monitoring

- Credit report and score tracking

- Solid alerting for new accounts and credit inquiries

- Good starting point for people focused mainly on credit risks

This option is especially appealing if your main concern is credit-related fraud and you want value without paying for extras you may not need.

Best for families

Aura Family Plan / IDShield Family Plan

Why they excel:

- Coverage for multiple adults and children

- Child identity monitoring

- Centralized family alert dashboards

- Scalable pricing as your household grows

Family plans deliver strong identity theft protection across generations with ease of management from a single account.

Best for recovery support

IDShield

Why it stands out:

- Licensed investigators integrated into the restoration process

- Personalized case handling

- Comprehensive monitoring and alerts

If minimizing stress during fraud recovery is your priority, IDShield’s investigator-led approach adds significant peace of mind.

Summary

Here’s a quick recap:

| Category | Best Choice | Why It’s Best |

| Best overall | Aura | Balanced monitoring, features, and support |

| Best budget | Experian Identity Theft Protection | Focused credit monitoring at lower cost |

| Best for families | Aura / IDShield | Strong family and child identity coverage |

| Best recovery support | IDShield | Expert-led restoration |

Final thoughts

Identity theft is not a question of “if” but “when,” and the right protection strategy can make all the difference between a minor inconvenience and a major disruption. Whether you choose free tools, paid services, or a hybrid approach, proactive monitoring and early detection are the keys to protecting your identity in 2026 and beyond.

Add a Comment